Pre-approval doesn’t equal FICO rigidity. Shop rates across tiers.

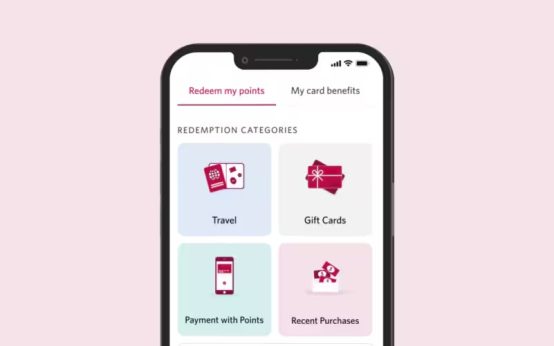

Apply online, manage payments via app, paperless process.

Secure lower rates post-purchase, escape high dealer APRs.

Pre-approved financing as a powerful tool in dealership talks.

-

The Specifics of Manufacturer Captive Financing: Toyota Financial Services +

Manufacturer captive finance companies, such as Toyota Financial Services (TFS), are often overlooked but can offer compelling rates, especially for new vehicle purchases and leasing. Their key differentiator is access to unique manufacturer incentives like low-APR special offers or cash-back programs tied directly to their financing. While they may have stricter underwriting standards than some online lenders, they are often the best option for U.S. consumers purchasing a brand-new vehicle who qualify for prime credit offers, as they leverage the factory’s marketing budget to subsidize rates. This exemplifies the Refinance Rate Lock-In benefit, as securing a great rate upfront can eliminate the need to refinance later.

-

Securing Auto Loans with an ITIN (Individual Taxpayer Identification Number)+

Not all U.S. residents have a Social Security Number (SSN), but many can secure auto financing using an Individual Taxpayer Identification Number (ITIN). This scenario is important for the U.S. market as it expands credit accessibility. Many regional credit unions and banks, often focusing on community outreach, are more familiar with this process than large national lenders, though specific requirements vary. This option is best suited for recent immigrants or non-residents establishing their financial history in the U.S. It directly connects to the Credit Score Flexibility, showing that credit history is still viable even without a traditional FICO profile tied to an SSN.

-

Private Party Used Car Financing: The Credit Union Advantage+

Financing a used car purchased from a private seller in the U.S. is a distinct scenario from a dealer purchase, and major Credit Unions like PenFed often excel here. While many banks only finance dealer sales, credit unions are generally more willing to offer specific “Private Party Auto Loans.” Their key differentiator is offering competitive rates and higher loan-to-value (LTV) ratios on these non-dealership transactions, sometimes even handling the title transfer process as a service. This option is ideal for U.S. buyers seeking better deals by cutting out the middleman and who value low rates, leveraging the purchasing power gained from Dealer Negotiation Leverage but in a private setting.

-

Exploring Lease Buyout Loans: A Post-Pandemic U.S. Trend+

A Lease Buyout Loan is a specific type of financing used when a U.S. consumer decides to purchase their leased vehicle at the end of the term, often to capture the car’s current market value which may exceed the residual value set in the lease agreement. The U.S. market has seen a surge in this activity due to high used car prices. Online lenders and fintechs like LightStream are often quick providers for this, treating it as a standard used car loan but with the benefit of the borrower already having possession and a pre-determined purchase price. This is best suited for lessees whose vehicle has positive equity or those who want to avoid the current high cost of new/used replacement vehicles, embodying the convenience of a Digital-First Experience for a fast closing process.

The PenFed Auto Loan Guide is designed to make this journey understandable and manageable, offering clear steps, helpful tools, and member-focused support every step of the way. This page serves as a simple and practical guide, helping you understand why financing through PenFed can be a smart decision, what to prepare before applying, and how to move through the U.S. auto loan process with confidence — from pre-approval to driving home.

Two Key Benefits Right Away:

• Competitive rates designed to reward strong financial habits

• Flexible terms that can help more borrowers reach affordable monthly payments

PenFed Auto Loan Guide empowers you to take control of your car-buying journey with confidence and clarity. As a credit union committed to serving its members, PenFed offers financing designed around real needs — not complicated requirements. Whether you have excellent credit, are rebuilding your financial life, or simply want a better experience than what the dealership offers, PenFed is prepared to help you move forward. With competitive auto loan rates, transparent terms, and helpful tools like pre-approval and online payment management, you get a smoother, more predictable path to vehicle ownership.

PenFed allows borrowers to shop freely, knowing their budget in advance while unlocking potential savings both at the dealership and with private sellers. From new models to reliable used vehicles and even refinancing opportunities to lower existing costs, PenFed supports a wide range of borrowing goals. With this guide, you’ll feel supported from application to approval — and beyond — with a trusted team by your side.

Top Auto Loan Options in the USA

Here’s where many U.S. consumers look when financing their next vehicle:

Traditional Banks (e.g., Chase, Wells Fargo, Capital One): Well-known lenders that reward strong credit with competitive APRs and convenient services tied to existing accounts.

Credit Unions (e.g., PenFed, Navy Federal, Alliant): Member-first organizations known for lower rates, fair qualification criteria, and personalized support through the full borrowing experience.

Manufacturer Financing (e.g., GM Financial, Toyota Financial Services): Dealer-linked lenders offering vehicle-specific promotions like cash incentives and low-APR deals on new models.

Online Lenders & Marketplaces (e.g., LightStream, Carvana, Ally Clearlane): Fast digital approvals, transparent pricing, and options for both dealership and private-party transactions.

PenFed Auto Loans: A trusted U.S. credit union offering accessible, competitive auto financing built around value and long-term savings for members.

Detailed Auto Financing Options

Traditional Bank Financing in the USA:

Major banks typically provide secured auto loans with fixed or variable terms, ideal for borrowers who want all financial services in one place. Pre-qualification helps estimate rates before impacting credit score.

PenFed Auto Loans:

PenFed stands out for highly competitive rates, flexible repayment schedules, and supportive options for diverse credit profiles. Members can finance new, used, or refinancing needs — including private-party purchases. A strong fit for drivers looking to save money over the life of their loan without sacrificing service quality.

Online Lending Platforms:

Digital lenders simplify everything from pre-approval to signing documents, making them ideal for remote shoppers or busy professionals. Some even coordinate shipping when buying online.

Personal Loans for Vehicle Purchases:

Unsecured options allow borrowers to buy from private sellers without using the vehicle as collateral. However, rates are usually higher than for traditional auto loans.

In-House “Buy Here Pay Here” Financing in the USA:

Often used by borrowers with limited or challenged credit histories. Convenient but usually with higher interest, shorter terms, and fewer consumer protections, so comparisons are essential.

How Car Loans Affect Your U.S. Credit Score

Your PenFed Auto Loan can play a valuable role in building and strengthening your credit history. Making on-time monthly payments consistently demonstrates responsible borrowing, helping you earn better rates on future financial products, including credit cards and mortgages. However, late or missed payments may harm your score and influence your debt-to-income ratio (DTI), a key metric lenders consider in major financial decisions. With PenFed, borrowers benefit from tools and guidance that help maintain healthy credit while staying comfortably within their financial limits.

You will stay on our website.