Lock in pre-approval rates, protected from rate hikes.

Digital platforms simplify signing, monitoring, and paying loans.

Refinancing opportunity if market rates drop or credit improves.

Firm financing offer means control over the final purchase price.

-

Navigating Incentives with Captive Lenders: Ford Credit Example+

Ford Credit, a prime example of a manufacturer’s captive finance arm, is essential for accessing highly subsidized APR deals and special seasonal incentives on new Ford vehicles. A key differentiator for U.S. buyers is their unique ability to bundle maintenance plans and warranty products into the loan directly from the factory source. While approval is often credit-tier dependent, they are best suited for consumers buying new models who qualify for promotional rates advertised by the manufacturer. This option maximizes the benefit of Rate Shopping Safety Net by offering deeply competitive initial terms.

-

Financial Inclusion: Auto Loans Using ITINs in the U.S.+

The option to secure vehicle financing with an Individual Taxpayer Identification Number (ITIN) addresses the diverse U.S. population. This process is frequently facilitated by smaller, local institutions and Community Development Financial Institutions (CDFIs) who specialize in non-traditional credit assessments. The critical distinction is that these lenders often focus on alternative proof of income and stable residency rather than just SSN-based credit reports. This resource is best suited for individuals establishing U.S. credit or those without an SSN. It underscores the value of Post-Purchase Rate Review , as initial ITIN loans may be refinanced once a traditional credit history is built.

-

Buying from Individuals: Utilizing Chase Bank for Private Party Loans+

When purchasing a vehicle directly from a private U.S. seller, securing financing can be challenging, but some large national banks, such as Chase Bank, offer structured Private Party Auto Loans. Their main benefit lies in established infrastructure and potentially fast funding once the agreed-upon price is reached. Unlike credit unions, their underwriting process for private sales may be more stringent regarding vehicle age/mileage. This service is ideal for existing Chase customers or those requiring the backing of a major financial institution for the transaction paperwork. It grants the borrower Empowered Dealership Visits level leverage in their private negotiations.

-

The Strategic End-of-Lease Move: Buyout Financing +

A Lease Buyout Loan has become a vital strategic tool for U.S. drivers, particularly with inflated used car values. It finances the residual value of a car at the end of a lease contract. Companies like Bank of America or local credit unions readily provide this funding, sometimes offering specific buyout programs. Their unique feature is simplifying the transition from lessee to owner, often with fewer fees than a dealer-facilitated purchase. This option is best suited for those with a clean, low-mileage leased vehicle to capture equity or secure a known asset, benefiting from the Seamless Loan Management features offered by major online banks.

The PenFed Auto Loan Guide is here to make that move feel clear and manageable. You’ll find real-world tips, straightforward steps, and support built around members — not sales quotas. This page explains why PenFed could be the right fit, what to organize before applying, and how to navigate the U.S. auto loan process with more confidence — from getting pre-approved to driving home.

PenFed Auto Loan Guide gives you the information and tools you need to take charge of your car-buying experience. As a member-driven credit union, PenFed focuses on practical lending and avoids unnecessary obstacles. Whether you have strong credit, are rebuilding, or simply want a more straightforward path than what a dealership offers, PenFed works to support your needs. With features like online pre-approval, transparent terms, and easy payment management, vehicle financing becomes more predictable and less stressful.

Shopping with PenFed means you already know your budget — giving you more control when comparing dealers or private sellers. From financing a newer model to choosing a budget-friendly used car, or even refinancing an old loan to cut costs, PenFed covers a wide range of goals. This guide walks with you through the entire process — before, during, and after approval — backed by a lending team focused on helping members succeed.

Top Auto Loan Options in the USA

A quick look at the most common places Americans finance a vehicle:

Traditional Banks (e.g., Chase, Wells Fargo, Capital One): Well-known lenders offering competitive APRs for borrowers with established credit and existing accounts.

Credit Unions (e.g., PenFed, Navy Federal, Alliant): Member-focused institutions recognized for lower rates and more personalized lending experiences.

Manufacturer Financing (e.g., GM Financial, Toyota Financial Services): Dealer-connected financing that often includes discounts, special APR promotions, or seasonal incentives.

Online Lenders & Marketplaces (e.g., LightStream, Carvana, Ally Clearlane): Fast approvals, digital tools, and flexible buying choices including private-party purchases.

PenFed Auto Loans: A trusted credit union offering competitive auto financing built around long-term value and member satisfaction.

Detailed Auto Financing Options

Traditional Bank Financing: Banks provide secured loans with predictable terms and helpful digital tools. Many allow soft-check pre-qualification so you can estimate payments without hurting credit.

PenFed Auto Loans: PenFed stands out with strong rate options, flexible repayment, and support for a wide range of credit backgrounds. Members can finance new, used, or refinance existing loans — even from private sellers — helping lower overall borrowing costs without sacrificing service.

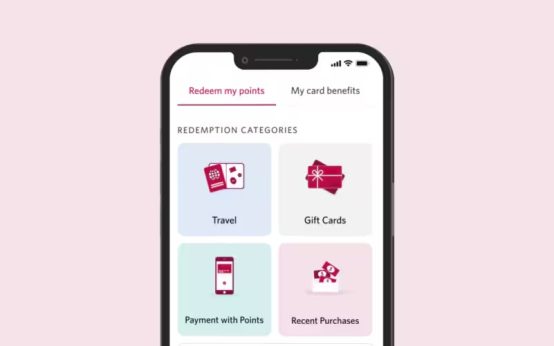

Online Lending Platforms: Digital lenders simplify the entire experience — from comparing rates to signing paperwork — ideal for people who prefer shopping online.

Personal Loans for Car Purchases: These unsecured loans don’t require the vehicle as collateral. Good for private sellers, but usually at higher interest rates than auto-secured loans.

In-House “Buy Here Pay Here” Financing: A quick option for borrowers facing credit challenges. However, these loans often come with higher APRs and fewer protections, so comparing offers is very important.

How Auto Loans Affect Your U.S. Credit Score

A PenFed Auto Loan can help build or strengthen your credit as long as payments are made on time. Steady repayment shows lenders you handle credit well, which can help unlock better financial options down the road. Missing payments, however, can hurt your score and affect your debt-to-income ratio (DTI), something lenders look at closely. PenFed provides tools and guidance to help borrowers stay on track and protect their financial progress while managing their monthly budget responsibly.

You will stay on our website.